India’s direct tax-to-GDP at 10-year high

The direct tax-to-GDP ratio of 5.98% achieved during 2017-18 is the best in the last 10 years, the Finance Ministry said on Wednesday. It was 5.57% in 2016-17 and 5.47% in 2015-16. The ministry said the larger purpose of demonetisation was to move India from a tax non-compliant society to a compliant society and the impact of note ban has been felt on collection of personal income tax.

GST easing for realty on the cards

The GST Council is slated to meet on January 10 to discuss lowering GST on under-construction flats and houses to 5%, as well as hiking exemption threshold for small and medium enterprises. The council, in its previous meeting on December 22, 2018, had rationalised the 28% tax slab and reduced rates on 23 goods and services.

Housing costs up in 33 cities

Housing prices increased in 33 cities by up to 22% during April-June quarter this fiscal, while rates fell in 14 cities by up to 13% and 3 cities remained stable, according to revised National Housing Bank data with new base year. For under-construction properties, housing prices went up in 39 cities by up to 17% and declined in 8 cities by up to 8% and remained stable in 3 cities. The National Housing Bank has revamped the system by changing the base year and releasing separate index for under construction properties.

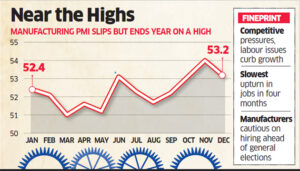

Manufacturing activity slows in December

India’s manufacturing activity expanded at a slower pace in December as growth in new orders and output moderated, despite factories cutting their prices. The Nikkei Manufacturing Purchasing Managers’ Index declined to 53.2 in December from 54 in November.

No end to US shutdown in sight No agreement came out of a meeting between US congressional leaders and President Donald Trump on Wednesday to end a partial government shutdown now in its 12th day as the president stuck to his demand for $5 billion in border wall funding fiercely opposed by Democrats.

Govt may ease mineral exploration policy

The government is considering liberalising the exploration and licensing regime for mineral exploration in India to attract big-ticket private investment in the sector. The plan includes an “Explore in India” mission, much on the lines of Skill India, Start-up India and Make in India, for the mining sector to reduce imports and tap India’s huge mineral wealth.

IOC, HPCL not to recoup Re 1/litre subsidy loss

State-owned oil firms have no plans to recoup losses they made on subsidising petrol and diesel by Re 1 per litre even though rates have now become at par with the cost, top officials said. “We are not recovering any of the losses,” Indian Oil Corp Chairman Sanjiv Singh told reporters. IOC along with Hindustan PetroleumNSE 1.19 % (HPCL) and Bharat Petroleum Corp Ltd took a hit of about Rs 4,500 crore from absorbing Re 1 a litre hike.

Crude mixed, gold up

US crude CLc1 dipped 1.31% at $45.93 a barrel after a sharp rise on Wednesday. Brent crude LCOc1 rose to $54.68 per barrel. Gold was higher as the dollar weakened, with spot gold XAU= trading at $1,286.54 per ounce.

Valuation bump-up won’t face tax bump

Companies faced with a 30% tax bill over valuation premiums are set to get a reprieve after a recent government clarification asked officials not to scrutinise such transactions, reports ET, adding that this could also bring some relief to startups on the angel tax front.

Australian dollar bloody after computer-driven crash

The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies. At one point it was down 5% on the yen and almost 4% on the US dollar, before clawing back much of the losses as trading calmed and humans took charge. Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash,’ said Ray Attrill, he head of FX strategy at National Australia Bank.

Rs 600 cr subsidy sops for merchant exporters

The government Wednesday decided to provide 3 per cent interest subsidy to merchant exporters, entailing an expenditure of Rs 600 crore, to enhance liquidity with a view to boosting outbound shipments. The decision was taken by the Cabinet Committee on Economic Affairs. A decline in export credit has hit exporters in general and MSME units in particular.

Automatic Swiss A/C info from 2019

From 2019, on an automatic basis, India will start receiving from Switzerland information relating to financial accounts held by Indians in Swiss banks, the government said Wednesday. Minister of State for External Affairs V K Singh, replying to a question in the Lok Sabha, said such information may include details about persons allegedly involved in corruption. However, the information received is governed by the confidentiality provisions of the tax treaty between the two countries.

POLICIES & MORE

The Tamil Nadu government has moved the Supreme Court challenging the recent order of National Green Tribunal setting aside a May 2018 Government Order closing Vedanta-owned Sterlite Copper and directing the state pollution control board to renew an operating licence of the 4-lakh-a-tonne factory within three weeks.

The cabinet yesterday approved the merger of Vijaya Bank & Dena Bank with Bank of Baroda. After today’s merger, Bank of Baroda will become the third biggest public sector bank. The merger will be effective from April 1

Lenders to Jet Airways are expected to step up pressure on the management to recover unpaid dues and raise money through equity or sale of assets after the airline revealed that it had defaulted for the first time in December.

FUNDAMENTALS

Rupee down: The rupee fell sharply yesterday against the US dollar amid weak domestic equities. The rupee settled at 70.17 a dollar, down 74 paise from its previous close of 69.43.

10-yr bond yields down: India 10-year bonds’ yields fell 0.02% to 7.35% on Wednesday from 7.37% in the previous trading session, according to RBI data.

Call rate: The overnight call money rate weighted average was 6.34% on Wednesday, according to RBI data. It moved in a range of 5.00-6.50%.