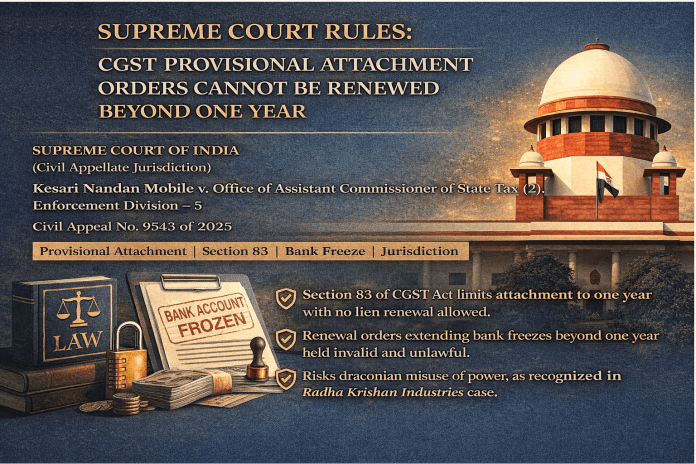

Kesari Nandan Mobile v. Office of Assistant Commissioner of State Tax (2), Enforcement Division – 5

Supreme Court of India

(Civil Appellate Jurisdiction)

Civil Appeal No. 9543 of 2025

Category: Provisional Attachment | Section 83 | Renewal of Attachment | Bank Account Freeze | Jurisdictional Limits

Date of Judgment: August 14, 2025

Relevant Provisions:

Section 83 of the CGST Act, 2017

Rule 159 of the CGST Rules, 2017

Article 14 of the Constitution of India

Facts of the Case

Appellant:

Kesari Nandan Mobile, a registered taxable person, whose bank accounts were provisionally attached during GST investigation proceedings.

Initial Attachment:

The respondent authority issued provisional attachment orders dated 17.10.2023 and 26.10.2023 under Section 83(1) of the CGST Act, attaching the appellant’s bank accounts (Para 2).

Statutory Lapse:

In terms of Section 83(2), the provisional attachment orders automatically ceased to have effect after expiry of one year, i.e., on 18.10.2024 and 27.10.2024 respectively (Para 2).

Fresh Attachment as “Renewal”:

Despite the statutory lapse, the respondent issued fresh provisional attachment orders dated 13.11.2024 and 18.12.2024, describing them as a “renewal” of the earlier attachments (Paras 2–3).

High Court Proceedings:

The Gujarat High Court dismissed the writ petition, holding that there was no statutory embargo on issuing a second provisional attachment order after lapse of the first (Para 3).

Question(s) in Consideration

Whether Section 83 of the CGST Act permits issuance of a second or renewed provisional attachment order after the original attachment has lapsed by efflux of one year under Section 83(2) (Para 14)?

Whether the revenue authorities can indirectly extend the life of a provisional attachment by issuing repeated orders on the same grounds (Paras 30–31)?

Observation of the Court

Plain Meaning of Section 83(2):

The Supreme Court held that Section 83(2) is clear and unambiguous—every provisional attachment shall cease to have effect after one year, and the statute provides no mechanism for renewal or extension (Paras 19–20).

Draconian Nature of Power:

Relying on Radha Krishan Industries, the Court reiterated that provisional attachment is a drastic, pre-emptive measure and must be strictly construed. Any interpretation diluting the statutory safeguard under Section 83(2) would be impermissible (Paras 17–18, 30).

No Power to Do Indirectly What Is Prohibited Directly:

Issuance of fresh attachment orders on substantially identical grounds after lapse of the earlier orders was held to be an abuse of power and contrary to the legislative intent (Paras 30–31).

Statutory Silence Is Not Authority:

The Court rejected the argument that absence of an express prohibition allows renewal. A statutory authority can act only when power is expressly conferred; lack of prohibition cannot be treated as permission (Paras 22, 28–29).

Attachment Not a Recovery Tool:

Provisional attachment cannot be used as a substitute for recovery proceedings. Once investigation culminates, the department must follow statutory recovery mechanisms (Paras 32).

Judgment of the Court

The Supreme Court held that:

Section 83 of the CGST Act does not permit renewal or re-issuance of a provisional attachment order after it lapses by operation of law.

Provisional attachment orders dated 13.11.2024 and 18.12.2024 were without jurisdiction and unsustainable.

Bank accounts attached pursuant to the impugned orders were directed to be de-freezed forthwith.

The civil appeal was allowed, while clarifying that investigation may continue strictly in accordance with law.

Between Fine Lines (Summary in Simple Terms)

A GST provisional attachment lasts only one year.

Once it expires, it cannot be renewed or reissued.

Authorities cannot keep bank accounts frozen indefinitely by passing fresh orders.

Provisional attachment is only a temporary safeguard, not a recovery method.

Statutory limits must be strictly respected.

Summary of Referred Cases

| Name of Case | Citation | Legal Principle | Treatment |

|---|---|---|---|

| Radha Krishan Industries v. State of H.P. | (2021) 6 SCC 771 | Provisional attachment is draconian; strict compliance required | Followed |

| RHC Global Exports Pvt. Ltd. v. Union of India | SLP (C) Nos.15992–15994 of 2023 | Attachment lapses after one year | Approved |

| Ali K. v. State Tax Officer | 2025 SCC OnLine Ker 758 | No power to renew lapsed attachment | Approved |

| Shrimati Priti v. State of Gujarat | 2011 SCC OnLine Guj 1869 | GVAT provisional attachment | Distinguished |

| Maniruddin Bepari v. Chairman, Municipal Commissioners | 1935 SCC OnLine Cal 296 | Statutory authority acts only within conferred power | Relied Upon |