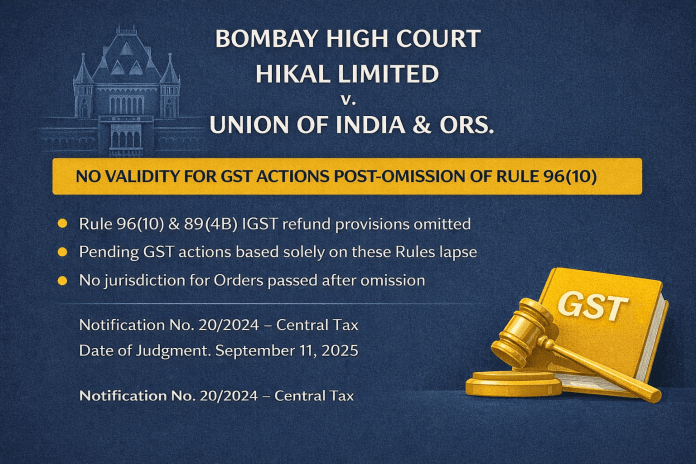

Hikal Limited v. Union of India & Ors.

High Court of Bombay

Writ Petition No. 78 of 2025

(Lead matter with multiple connected writ petitions)

Category: IGST Refund | Export on Payment of Tax | Rule 96(10) | Rule 89(4B) | Omission of Rules | Lapse of Proceedings

Date of Judgment: September 11, 2025

Relevant Provisions:

Section 16 of the IGST Act, 2017

Section 54 of the CGST Act, 2017

Section 73 & 74 of the CGST Act, 2017

Section 164, 166 & 174 of the CGST Act, 2017

Rule 96(10) and Rule 89(4B) of the CGST Rules, 2017

Notification No. 20/2024–Central Tax dated 08.10.2024

Section 6 of the General Clauses Act, 1897

Facts of the Case

Petitioner:

Hikal Limited, engaged in manufacture of specialty chemicals and active pharmaceutical ingredients, operating both a 100% Export Oriented Unit and a Domestic Tariff Area unit (Paras 10–11).

Export & Refund Structure:

The petitioner exported goods on payment of IGST and claimed refund under Section 54 of the CGST Act read with Section 16 of the IGST Act. Refunds were sanctioned and not initially disputed by the Department (Para 11).

Revenue Action:

In 2022, the Department initiated investigation alleging violation of Rule 96(10) on the ground that some inputs were imported duty-free under Advance Authorisation. A show cause notice dated 04.08.2024 was issued proposing demand of over ₹67 crore (Paras 12–13).

Subsequent Development:

During pendency of proceedings, Rule 96(10) and Rule 89(4B) were omitted vide Notification No. 20/2024 dated 08.10.2024, without any express savings clause (Para 13).

Adjudication Despite Omission:

Despite specific objection regarding omission of the Rule, the adjudicating authority passed an order confirming demand on 23.01.2025 (Para 14).

Question(s) in Consideration

Whether omission of Rule 96(10) and Rule 89(4B) without a savings clause results in lapse of pending proceedings, including show cause notices and adjudication orders (Paras 42–47)?

Whether Section 6 of the General Clauses Act or Sections 166 / 174 of the CGST Act save pending proceedings after omission of delegated legislation (Paras 42, 58–65)?

Whether proceedings can continue when the sole basis of allegation is breach of an omitted Rule (Paras 5–9, 66–67)?

Observation of the Court

Effect of Omission Without Savings Clause:

The Court reaffirmed the common law principle that omission or repeal of a provision without a savings clause obliterates it from the statute book as if it never existed, except for “transactions past and closed” (Paras 59–65).

Section 6 of General Clauses Act Inapplicable:

Section 6 does not automatically apply to omission of Rules. Even otherwise, requirements of Section 6 were not satisfied in the present case (Paras 22–24, 39–40).

Pending Proceedings Not Saved:

Show cause notices and adjudication orders based solely on Rule 96(10) could not survive after 08.10.2024. Proceedings which had not attained finality were not “transactions past and closed” (Paras 66–67).

Adjudication After Omission Void:

Any adjudication order passed after omission of the Rule, relying on such Rule, was held to be without jurisdiction (Paras 14, 66).

No Need to Decide Constitutional Validity:

Although extensive arguments were advanced on constitutional validity, the Court deliberately refrained from deciding the issue since the petitions succeeded on the ground of omission alone (Paras 43–47).

Judgment of the Court

The Bombay High Court held that:

Omission of Rule 96(10) and Rule 89(4B) without a savings clause resulted in lapse of all pending proceedings based solely on those Rules.

Show cause notices, recovery actions, and adjudication orders relying exclusively on the omitted Rules were unsustainable in law.

Orders passed after 08.10.2024 invoking the omitted Rules were without jurisdiction.

Petitioners were entitled to consequential reliefs, including quashing of demands and continuation of refund claims without reference to the omitted Rules.

Between Fine Lines (Summary in Simple Terms)

Once Rule 96(10) was deleted, it legally ceased to exist.

Tax authorities cannot continue or conclude cases based only on a deleted rule.

No savings clause means pending cases automatically lapse unless finally concluded.

Orders passed after deletion are invalid.

Export refunds cannot be denied using a rule that no longer exists.

Summary of Referred Cases

| Name of Case | Citation | Legal Principle | Treatment |

|---|---|---|---|

| Rayala Corporation v. Director of Enforcement | (1969) 2 SCC 412 | Repeal without saving clause wipes out pending proceedings | Followed |

| Kolhapur Canesugar Works v. Union of India | (2000) 2 SCC 536 | Section 6 GCA not applicable to repeal of Rules | Relied Upon |

| Fibre Boards Pvt. Ltd. v. CIT | (2015) 10 SCC 333 | Scope of Section 6, repeal vs omission | Discussed |

| Gammon India Ltd. v. State of Maharashtra | (2006) SCC 354 | Effect of repeal on pending actions | Applied |

| Sance Laboratories Pvt. Ltd. v. Union of India | 2024 (Ker HC) | Rule 96(10) unconstitutional | Noted |

| Addwrap Packaging Pvt. Ltd. v. Union of India | 2025 (Guj HC) | Omission of Rule 96(10 lapses proceedings | Followed |