Case Details:

| Particular | Details |

| Case No. | WP(C) NO. 548 OF 2021 |

| Case Name | Commissioner of Central Excise, Custom Central Goods & Service Tax v. Black berryIndia (P.) Ltd. |

| Court | Supreme Court of India |

| Date of Judgement | 19-01-2024 |

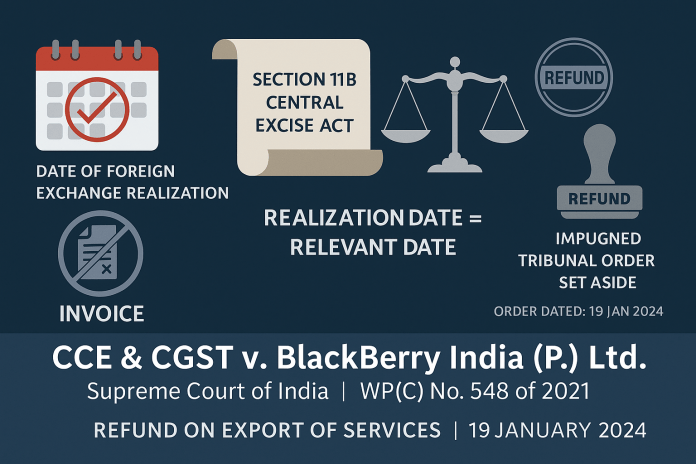

Issue- In the above case, the issue was related to refund of unutilized credit on export of services.

Held – The Appellate Tribunal in its impugned order had held that it is settled in catena of decisions of Tribunal that date of realisation of foreign exchange is relevant date for claiming refund of unutilized credit on export of services because export is complete only on such realization. Nothing in Section 11B of Central Excise Act, 1944 as applicable to Service Tax mandates that date of invoice must be considered as relevant date. Residue entry under this provision is date of payment of duty and in case of export, there is no question of payment of duty. Accordingly residual entry of aforesaid provisions not applicable. C.B.E. & C. itself has subsequently amended relevant notification to bring it in line of these decisions. Impugned order was set aside and refund allowed.